In the opening days of 2026, three seemingly separate events sent quiet shockwaves through global politics, commodities, and energy markets.

In Venezuela, President Nicolás Maduro was captured in a dramatic overnight operation that ended more than a decade of hardline rule. In Beijing, Chinese regulators quietly tightened control over silver exports, reshaping how one of the world’s most strategic metals reaches global markets. And in Houston and New York, energy analysts began circling the same question: Which U.S. oil companies stand to gain the most from what happens next?

Individually, each development matters. Together, they signal a broader shift toward state power reasserting control over strategic resources—oil, metals, and the chokepoints that move them.

Here’s what happened, who was involved, and why markets are paying attention.

The Capture of Nicolás Maduro: Who Actually Carried It Out?

The capture of a sitting head of state is one of the rarest and most sensitive operations in modern geopolitics. It doesn’t happen accidentally—and it doesn’t happen without elite forces.

According to multiple detailed reports, the operation that led to Nicolás Maduro’s capture was executed by U.S. special operations forces, with Delta Force at the center.

Delta Force: The Tip of the Spear

The primary unit responsible for physically securing Maduro was 1st Special Forces Operational Detachment–Delta, commonly known as Delta Force.

Delta Force is the U.S. military’s most elite direct-action unit, designed specifically for:

-

high-value target captures,

-

counterterrorism raids,

-

and operations requiring extreme precision in hostile environments.

This was not a battlefield engagement. It was a snatch operation—fast, controlled, intelligence-driven, and designed to end with a living detainee, not a body count.

Delta operators reportedly rehearsed the raid using a replica of Maduro’s residence, a standard practice for missions where seconds and angles matter.

The Night Stalkers: Getting In and Out Alive

Supporting the ground assault was the 160th Special Operations Aviation Regiment (SOAR)—better known as the “Night Stalkers.”

Their role:

-

low-altitude helicopter insertion,

-

precision timing under cover of darkness,

-

and extraction under hostile fire.

At least one aircraft reportedly took damage during the operation, underscoring how close the mission came to escalation.

Delta Force may have secured the target—but without the 160th, the mission doesn’t happen.

Intelligence Made It Possible

Operations like this live or die on intelligence.

Months before the capture, CIA personnel were reportedly on the ground developing Maduro’s daily movement patterns. A human intelligence asset close to the Venezuelan president allegedly provided real-time confirmation of his location on the night of the raid.

That intelligence allowed U.S. planners to strike at the exact moment Maduro was most vulnerable—and least protected.

Law Enforcement Presence

Once Maduro was secured, U.S. federal law-enforcement agents, including the FBI, were involved in processing and custody. There were also indications—though less formally confirmed—that DEA personnel played a role, likely tied to longstanding narcotics allegations against the Maduro regime.

The Big Picture

This was not a rogue action or symbolic arrest. It was a multi-agency, multi-month operation involving:

-

Delta Force (direct action),

-

160th SOAR (aviation),

-

CIA (intelligence),

-

and federal law enforcement (custody and legal handling).

In short: the most elite units the U.S. has.

China’s Silver Export Restrictions: What Changed on January 1, 2026?

While headlines focused on Caracas, Beijing made a quieter move—one that commodity traders noticed immediately.

On January 1, 2026, China implemented new silver export controls under an updated state-trading framework. Despite online chatter calling it a “ban,” the reality is more subtle—and more powerful.

Not a Ban, a Gate

China did not outlaw silver exports. Instead, it restricted who is allowed to export silver at all.

Under the new rules:

-

Silver exports must pass through state-approved trading enterprises.

-

Only companies meeting strict production, compliance, and verification standards qualify.

-

Export eligibility is reviewed, published, and subject to objection before approval.

This turns silver exports into a licensed privilege, not a routine commercial activity.

The Key Restriction That Matters Most

For new exporters, the most important requirement is scale.

To qualify, a company must have produced:

-

at least 80 metric tons of silver in 2024, or

-

40 metric tons if operating in China’s western regions.

Smaller producers? Effectively locked out.

Why China Did This

Silver is no longer just a precious metal. It’s a strategic industrial input:

-

solar panels,

-

advanced electronics,

-

defense applications,

-

and energy infrastructure.

By limiting exports to large, state-vetted players, China:

-

tightens control over global supply,

-

reduces leakage during shortages,

-

and gains leverage over downstream industries.

This mirrors what China has already done with rare earths, gallium, germanium, and graphite.

The message is clear: strategic materials move on Beijing’s terms.

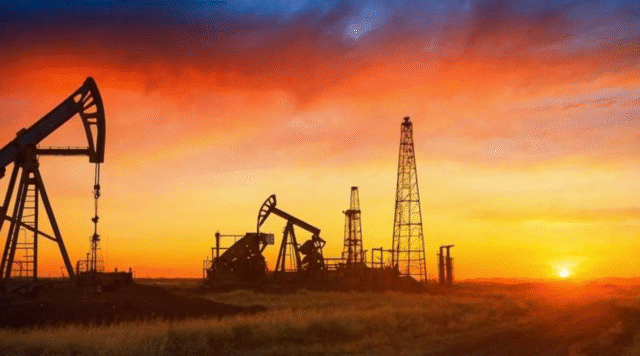

So Who Benefits? U.S. Oil Companies in Focus

With Maduro removed and China tightening commodity controls, attention quickly turned to the U.S. energy sector.

But “benefit” depends on time horizon.

Short Term Winners: U.S. Gulf Coast Refiners

The fastest impact comes from oil flows.

Venezuela produces heavy crude, the kind that:

-

many U.S. Gulf Coast refineries are specifically designed to process,

-

and that had increasingly been shipped to China under sanctions workarounds.

If Venezuelan barrels re-route away from China and back toward the Western Hemisphere, U.S. refiners benefit immediately.

These refineries:

-

get access to compatible feedstock,

-

reduce reliance on alternative heavy blends,

-

and improve margins.

This is why analysts describe the situation as an “immediate boost” for U.S. refiners, even before any major upstream investments resume.

Medium to Long Term Winners: The U.S. Oil Majors

Rebuilding Venezuela’s oil industry will take years. But if sanctions ease and contracts are renegotiated, a familiar set of names re-enters the picture.

Chevron

Chevron is the most immediately positioned U.S. company:

-

it already held limited waivers to operate in Venezuela,

-

has existing joint ventures,

-

and maintains institutional knowledge of the fields.

If the door opens even slightly, Chevron walks through first.

Exxon Mobil

Exxon was forced out during Venezuela’s nationalization wave and is owed billions. Any serious restructuring of the Venezuelan oil sector will involve resolving Exxon’s claims—making it both a stakeholder and a potential beneficiary.

ConocoPhillips

Like Exxon, ConocoPhillips holds outstanding claims and historical assets tied to Venezuela. It is well positioned if a settlement framework emerges.

The Reality Check

Even with political change, Venezuela’s production won’t snap back overnight. Infrastructure is degraded, capital is scarce, and trust must be rebuilt.

But markets move on direction, not perfection.

And the direction—at least for now—points toward:

-

renewed Western involvement,

-

gradual normalization,

-

and selective winners in U.S. energy.

Why These Stories Are Connected (Even If They Don’t Look Like It)

Maduro’s capture, China’s silver restrictions, and rising interest in U.S. oil companies all reflect the same underlying truth:

Resources don’t move freely anymore. Power decides where they go.

States are reclaiming control over:

-

leaders,

-

metals,

-

energy flows,

-

and strategic chokepoints.

For investors, businesses, and policymakers, the lesson is simple:

the era of assuming open markets is over.

The era of managed access has begun.