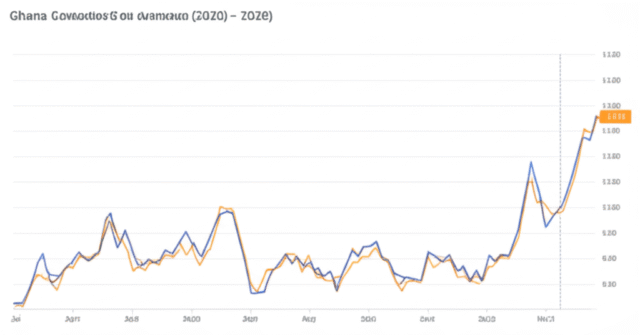

The Ghanaian Cedi’s Resurgence: Analyzing its Strength Against the US Dollar

After periods of significant volatility, the Ghanaian Cedi (GHS) has recently shown notable signs of strengthening against the United States Dollar (USD). This upward trend is a significant development for Ghana’s economy and warrants a closer look at the factors driving its performance and the implications for various stakeholders.

Factors Contributing to the Cedi’s Appreciation:

Several key elements often contribute to a currency’s rise, and the Cedi’s recent performance can be attributed to a combination of internal and external dynamics:

- Improved Macroeconomic Stability: A primary driver for currency appreciation is often a perception of improved macroeconomic stability. This can include:

- Fiscal Consolidation: Efforts by the Ghanaian government to manage debt, reduce budget deficits, and implement disciplined spending measures can instill confidence in the Cedi.

- Monetary Policy Effectiveness: The Bank of Ghana’s actions, such as interest rate decisions and liquidity management, play a crucial role in stabilizing the currency. Tighter monetary policy, aimed at curbing inflation, can make the Cedi more attractive to investors.

- Reduced Inflation: A downward trend in inflation can boost real returns on investments in Ghana, making Cedi-denominated assets more appealing.

- Increased Foreign Exchange Inflows: A surge in foreign currency coming into Ghana can significantly bolster the Cedi. This can stem from:

- Enhanced Investor Confidence: Positive sentiment among foreign investors, potentially driven by good economic data, political stability, or attractive investment opportunities, can lead to increased foreign direct investment (FDI) and portfolio investment.

- Higher Commodity Prices: Ghana is a significant exporter of commodities like gold, cocoa, and oil. Favorable global prices for these exports can increase foreign exchange earnings.

- Remittances: Consistent and strong remittances from Ghanaians living abroad contribute a steady stream of foreign currency.

- Successful Loan Disbursements: The disbursement of funds from international financial institutions or bilateral partners (e.g., IMF programs) can provide a substantial injection of foreign exchange reserves.

- Stronger Export Performance: A robust performance in Ghana’s export sectors means more foreign currency is being earned and brought into the country, increasing the supply of foreign exchange relative to demand.

- Demand Management Measures: The Bank of Ghana or government might implement measures to manage the demand for foreign currency, such as restricting imports or encouraging local production, which can indirectly support the Cedi.

- Global US Dollar Weakness: While the focus is on the Cedi’s strength, a general weakening of the US Dollar globally due to shifts in US economic policy, interest rate differentials, or other global financial trends can also contribute to the Cedi’s relative rise.

Implications of a Stronger Cedi:

A strengthening Cedi has multifaceted implications for various sectors of the Ghanaian economy:

- For Importers:

- Lower Import Costs: A stronger Cedi means it costs less local currency to purchase foreign goods, potentially leading to lower prices for imported goods and services.

- Reduced Operational Costs: Businesses that rely on imported raw materials or machinery will see their costs decrease.

- For Exporters:

- Reduced Competitiveness: A stronger Cedi makes Ghanaian exports more expensive in international markets, potentially reducing their competitiveness and affecting export volumes and revenues.

- Lower Cedi Earnings: Exporters will receive fewer Cedis for the same amount of foreign currency earned.

- For Consumers:

- Potential for Lower Prices: If import costs decrease, consumers might benefit from lower prices for a range of goods, especially imported ones.

- Increased Purchasing Power Abroad: Traveling or making online purchases in foreign currencies becomes more affordable.

- For Foreign Investors:

- Higher Returns (if investing in GHS-denominated assets): If the Cedi appreciates while an investor holds Cedi-denominated assets, their returns, when converted back to their home currency (e.g., USD), would be higher.

- Entry Point Considerations: New foreign investors might find it more expensive to enter the Ghanaian market if their capital is in USD.

- Inflation Control: A stronger Cedi can help to rein in imported inflation, as the cost of foreign goods becomes cheaper.

Conclusion:

The recent appreciation of the Ghanaian Cedi against the US Dollar is a positive sign for Ghana’s economic stability and reflects a combination of strategic domestic policies and favorable external conditions. While it brings benefits like lower import costs and potential inflation control, it also presents challenges for exporters. Continuous monitoring of macroeconomic indicators and adaptive policies will be crucial to sustain this positive trend and leverage its benefits for broad-based economic growth.