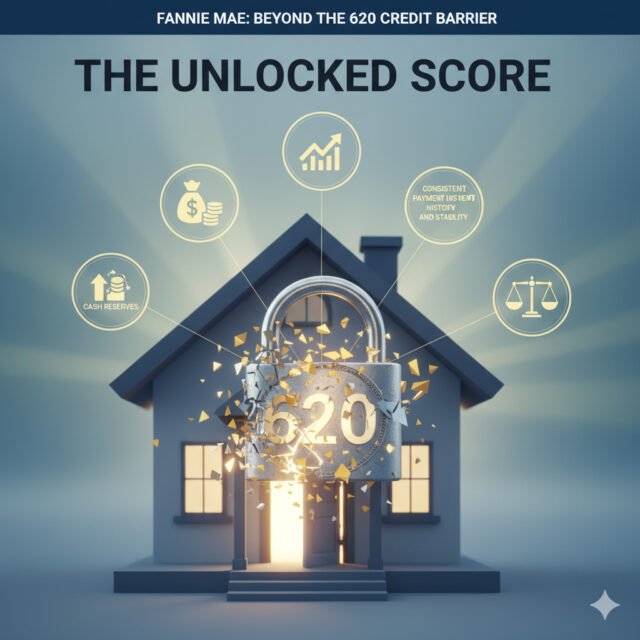

In a move set to redefine the landscape of mortgage eligibility, Fannie Mae, one of the leading government-sponsored enterprises (GSEs) responsible for providing liquidity and stability to the U.S. housing market, has announced a landmark change: the elimination of the minimum 620 credit score requirement for conventional loans processed through its automated underwriting system, Desktop Underwriter (DU).

Effective for new loan casefiles created on or after November 16, 2025, this shift is more than a simple numerical adjustment; it signifies a philosophical transition from a rigid score-based cutoff to a holistic, risk-based assessment of a borrower’s overall financial profile. This decision, following a similar move by its counterpart, Freddie Mac, is poised to have a profound impact on housing access, affordability, and the dynamics of the American housing market.

1. The End of an Era: Removing the 620 Barrier

For years, a minimum representative credit score of 620 has served as a critical gatekeeper for conventional loan eligibility. This score was a baseline benchmark for creditworthiness that borrowers had to clear to even have their file considered for a Fannie Mae-backed mortgage.

The rationale behind this floor was simple: a low credit score historically correlated with a higher risk of default. However, the 620 minimum began to feel less like a measure of risk and more like an unnecessary barrier to entry for financially responsible individuals with “thin” or non-traditional credit files.

The Shift to a Holistic Review

Fannie Mae’s official announcement confirms that the minimum score requirement is being replaced with a minimum credit risk standard based on a comprehensive evaluation within the Desktop Underwriter system. The DU platform will now weigh a broader set of risk factors, including:

• Debt-to-Income (DTI) Ratio: A borrower’s existing debt load relative to their monthly income.

• Cash Reserves: The amount of savings available after the closing of the loan.

• Down Payment Size: A larger down payment can offset other perceived risks.

• Payment History: A detailed look at past performance, now with greater flexibility for non-traditional credit.

The goal is to allow the system to approve loans for “near-miss” borrowers—those with consistent income, solid reserves, and responsible payment habits but whose credit score may have been kept below the threshold due to limited history or past financial missteps that are now well behind them.

2. 🧑🤝🧑 Implications for Borrowers: Expanding the Homeownership Universe

The most direct and celebrated impact of this policy change is the potential expansion of the eligible borrower pool, a significant step toward inclusive homeownership.

The “Credit-Invisible” and Thin-File Borrowers

This policy offers a lifeline to borrowers who are creditworthy but have limited traditional credit history. This group includes recent immigrants, young adults, and long-term renters. While credit scores will still be requested for compliance and pricing, the DU system is now explicitly designed to prompt lenders for documentation of non-traditional credit history when a borrower lacks sufficient data for a traditional score or has a very limited file.

3. The Role of Non-Traditional Credit: Opening the Door for Renters

This policy change fundamentally alters the definition of creditworthiness by allowing a more complete picture of a borrower’s financial responsibility.

• New Credit Data: The removal of the 620 minimum allows DU to more heavily weigh and request data like on-time rental payments, utility payments, and cell phone payments.

• Documentation: Lenders can now use various methods to document a consistent, on-time non-traditional credit history, including canceled checks, bank statements showing regular debits, and direct verification from landlords or service providers.

• Focus on Housing History: For borrowers without traditional credit, the ability to document a consistent, on-time housing payment history (rent) is particularly critical, often reducing or eliminating required cash reserves.

For many long-term renters, the system is moving past penalizing them for avoiding traditional credit, and instead is rewarding them for demonstrating payment consistency on core monthly obligations.

4. ⚖️ Conventional vs. FHA: Navigating Mortgage Options with a Lower Credit Score

This new eligibility standard directly impacts the competition between conventional loans and FHA loans—the traditional path for lower-score buyers.

If a borrower with a 600 score qualifies for a conventional loan, they might choose it over an FHA loan to avoid the mandatory, often lifelong Annual Mortgage Insurance Premium (MIP)—a significant long-term savings.

5. Risk vs. Inclusion: Analyzing the Next Housing Crisis Guardrails

A major debate centers on whether removing the minimum score constitutes a “loosening” of underwriting standards that could risk the stability of the housing market.

• The Pre-2008 Distinction: The policy is fundamentally different from the pre-2008 crisis where widespread fraud and “stated income” (no documentation) loans were common. The new standard still requires full documentation of income, assets, and liabilities.

• The New Guardrails: Fannie Mae stresses that the elimination of the score minimum is a technological refinement based on highly sophisticated risk modeling, not a relaxation of the fundamental ability-to-repay principle. The new DU platform simply uses a richer, more predictive data set than a single, static score to determine sustainable risk.

• FHFA Oversight: The change is mandated under the oversight of the Federal Housing Finance Agency (FHFA), which ensures the GSEs promote sustainable and responsible access to credit while maintaining market stability.

6. 🎯 Anticipated Lender Reaction: Overlays and Prudent Lending

While Fannie Mae has removed its minimum score, lenders are not mandated to follow suit immediately or entirely. Lenders will likely adopt a cautious approach by using “overlays.”

• What are Overlays? An overlay is an internal lending guideline that is stricter than the minimum requirements set by Fannie Mae. Lenders use them to manage their own risk tolerance and maintain the quality of their loan portfolios.

• Likely Overlays: For loans approved below the 620 mark, lenders are likely to demand:

• Stronger Compensating Factors: Requiring exceptionally low DTI ratios (e.g., 38% maximum) and higher cash reserves (e.g., 6 months of mortgage payments).

• Larger Down Payments: Pushing for 5-10% down, even if 3% is technically allowed by Fannie Mae.

• Stricter History Review: Requiring a spotless payment history over the last 12-24 months to offset the low score.

The actual impact on loan volume will therefore depend heavily on the risk appetite of individual lenders and how aggressively they adopt the new, more flexible guidelines.

7. 🔮 The Unintended Consequences: Pricing and Inventory Pressures

While designed for inclusion, the policy’s success is tied to broader housing market economics.

LLPAs & Affordability

The primary check on high risk is not the credit score itself, but the Loan-Level Price Adjustments (LLPAs).

• LLPAs Defined: These are risk-based fees applied to conventional mortgages based on factors like the credit profile and Loan-to-Value (LTV) ratio.

• The Cost: Borrowers with lower credit scores and smaller down payments will face significantly higher LLPAs, which translate directly into a higher interest rate or higher upfront fees at closing. This is the market’s way of pricing the risk. While a borrower may now qualify with a 590 score, the resulting LLPA-driven interest rate may still make the loan unaffordable.

Inventory Crisis

Allowing more borrowers into the conventional market will increase demand. In a market already facing historically low housing inventory, this surge of new buyers could:

• Exacerbate Bidding Wars: Intensify competition for the limited homes available.

• Drive Up Prices: Put significant upward pressure on home prices, potentially offsetting the affordability gains from easier credit access for all buyers.

Conclusion: A Progressive Step with Market Complexity

Fannie Mae’s decision to remove the 620 minimum credit score requirement is a progressive, landmark step that directly addresses the challenges of housing accessibility for a growing segment of the American population. It marks the formal end of the singular credit score as an absolute gatekeeper for conventional financing.

The ultimate success of this initiative will be defined by its balance: does it lead to a sustainable and responsible expansion of homeownership, or will it simply fuel demand that is absorbed by rising prices? The answer lies in the careful application of the new holistic underwriting models and the prudent use of lender overlays to ensure financial stability for all.